Are you interested in the personal finance niche? or you probably need more insight into how personal finance blogs are monetised.

This article is the right resource for you because you will learn the key ways to make money with a personal finance blog, including useful ideas and tips to help anyone kickstart their blogging journey in this niche.

Is personal finance a profitable niche?

Personal finance ranks among the most profitable niches on the internet. It has many sub-niches with high demand. These include investing, loans, saving money, budgeting, mortgages, insurance, frugal living etc.

Each niche in personal finance addresses a problem or answers questions relating to personal income, expenses or opportunities to make money for oneself.

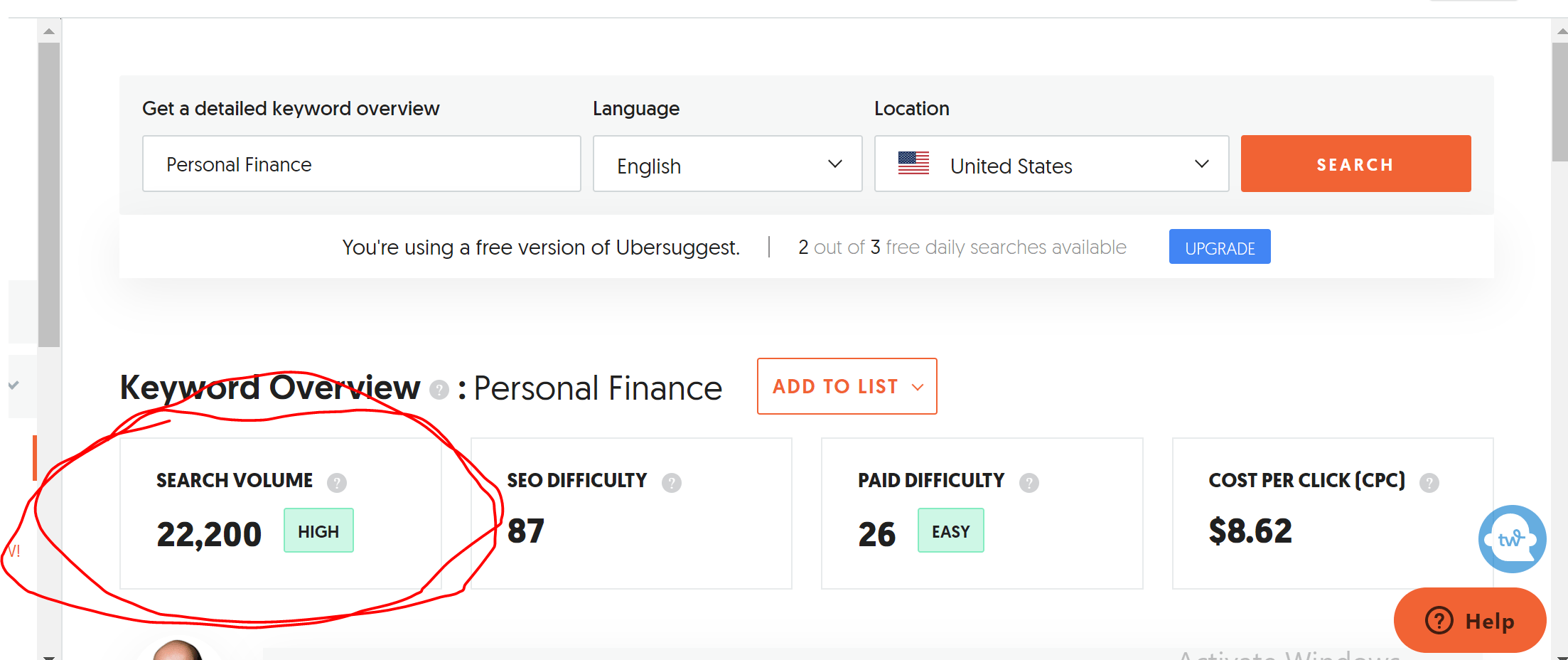

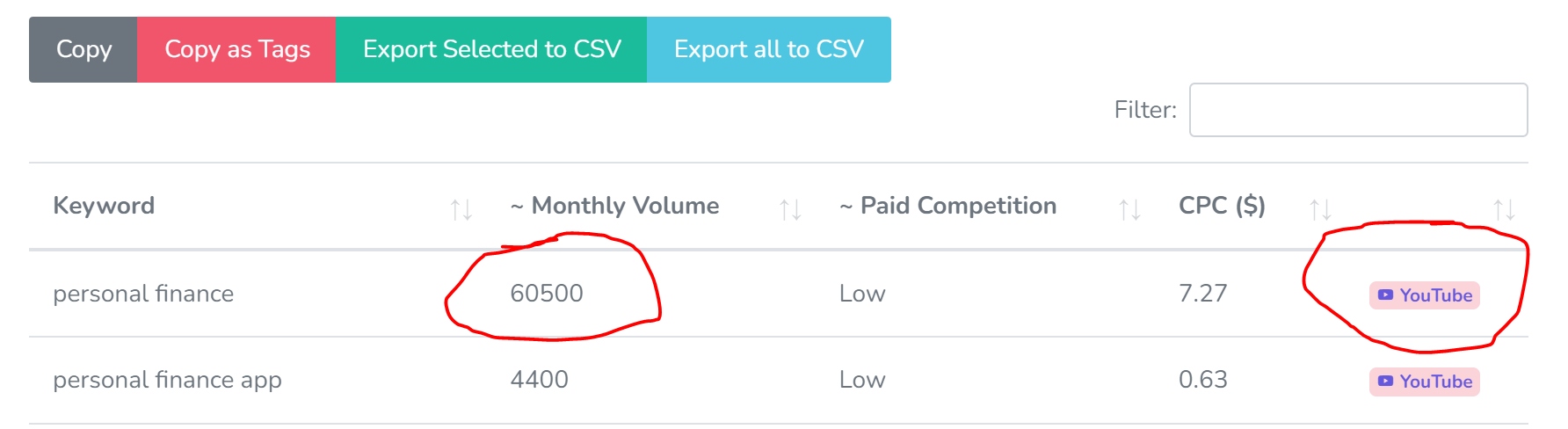

Personal finance keywords have over 22,200 and 60,500 searches on Google and YouTube respectively. The niche has low-paid competition.

However, personal finance keywords have an SEO difficulty of 87+, which makes the niche competitive for beginners, in terms of organic traffic generation.

Narrowing it down to a specific sub-niche is key to succeeding in this niche.

Are personal finance blogs profitable?

Personal finance blogs are among the most lucrative blogging businesses in the world.

Personal Finance has an $8.62 average cost per click. This makes monetization with ad networks easy in the first few months after launch.

Your profitability depends on your monetization methods and traffic.

Traffic is the oxygen of every website.

To drive traffic to your site, you need to write SEO-optimised content.

Also Read: How To Become An SEO Content Writer (The Complete Guide)

How much do Personal Finance Blogs Make?

It depends on how much traffic a personal finance blog gets and the monetization strategy in use.

The top personal finance bloggers make $200,000 to one million dollars a year from the sale of goods and services, combined with affiliate commissions and ad revenue.

Top Earners in the Personal Finance Niche

The list below shows statistics on personal finance blog traffic and their income report for top personal finance bloggers in the world.

1. The Money Habit

Website: themoneyhabit.org

Founder: J.P Livingston

Monthly Income: $7,708 (2022 monthly average)

Traffic: Over 120,000 page views (Source: similar web)

Blog’s Age: 6 years (Launched in 2016)

Monetization: Affiliate marketing and Ad revenue

According to CNBC, J.P Livingston retired with 2.25 million dollars at age 28. The Money Blogger makes 96 per cent of her income from affiliate marketing. J.P. Livingston spends only 5 hours a week blogging and earns an average of $92,496 annually.

2. The Practical Saver

Website: thepracticalsaver.com

Founder: Allan Liwanag

Monthly Income: $7,864.5 (2022 monthly average)

Traffic: Over 16,000+ monthly page views (Source: similar web)

Blog’s Age: 6 years+ (Launched in 2016)

Monetization: Sponsorships, Affiliate marketing and Ad revenue

Allan shares ideas on money management, paying off debts and budgeting. He earned $5,000 in 8 months. This is a rare record in blogging. His blog’s income comes from affiliate marketing and sponsored posts.

3. Freedom in a Budget

Website:freedominabudget.com

Founder: Kelly Ann Smith, South Florida

Monthly Income: $5,046 (2021 monthly average)

Traffic: 17,200 monthly page views (Source: Similar web)

Blog’s Age: 6 years+ (Started in 2016)

Monetization: Product sales, coaching and donations

Kelly Ann is a Florida-based lifestyle and personal finance blogger. Kelly and her husband have used Kelly’s blogging profits to save and make a down payment for their home. They had earlier paid off their wedding debts from the profits earned from blogging.

4. The Savvy Couple

Website: thesavvycouple.com

Founders: Kelan and Brittany Kline

Monthly Income: $43,547 (2021 monthly average)

Traffic: 191,000+ monthly page views (Source: Similar web)

Blog’s Age: 6 years+ (at the time of this report)

Monetization: Ad network, affiliate marketing, sponsorships.

The Savvy Couple were able to grow their blogging business in three years and paid off $250,000 in student loans. They resigned from their full jobs to grow the blogging business. They have a net worth of $200,000+

5. Believe in a Budget

Website: believeinabudget.com

Founder: Kristin Larsen

Monthly Income: $113,175 (2022 monthly average)

Traffic: 10,700+ monthly page views (Source: Similar web)

Blog’s Age: 7 years (at the time of this report)

Monetization: Ad networks, affiliate marketing, products and services.

In the third year of blogging, Kristin Larsen made $290,000 (source). A chunk of her income came from promoting a course on her blog. After 10 months of blogging, Kristin was able to quit her job and focus on the things that make her happy, while growing her blogging business.

6. Making Sense of Cents

Website: makingsenseofcents.com

Founder: Michele Schroeder-Gardner

Monthly Income: $ 208,859 (2022 monthly average)

Traffic: 246,500+ monthly page views (Source: similar web)

Blog’s Age: 10 years (at the time of this report)

Monetization: Ad networks, affiliate marketing, products and services.

Michele Schroeder-Gardner is a leading personal finance blogger with a large email subscriber list. She grew her blogging business from scratch.

Her blogging success stories have been featured in Forbes and Business Insider.

She earns a yearly $2,506,194 (average) from blogging.

How do personal finance blogs make money?

Personal finance bloggers make money from;

- Display Ads (Google Adsense, Ezoic, Mediavine etc)

- Sale of eBooks

- One-on-one coaching

- Personal finance apps

- Subscription-based Memberships

- Online personal finance courses

- Sponsored post

- Selling of ads spaces on their blogs/websites

- Affiliate marketing and

- Voluntary donations by readers

51+ Personal Finance niche ideas

Personal Finance has so many areas or niches. To become a profitable personal finance blogger, you need to niche down and have an area of focus.

We have compiled over 50 niche ideas to help you get started;

- Personal finance for beginners

- Retirement planning

- Mortgages

- Business loans

- Student loans

- Auto insurance

- Credit cards

- Credit reporting

- Budgeting

- Personal savings

- Managing personal expenses

- Financial Intelligence

- Personal finance for teens and children

- Starting a Side Hustle

- Early retirement education

- Investing in stocks

- Cryptocurrency

- Managing bankruptcy

- Personal finance for students

- Personal finance for single moms

- Personal finance for men

- Personal finance tips for career women

- Managing debt or loans

- Saving for a purpose

- General advice on investing

- Financial planning

- Personal income tax education and tax filing

- Wealth management

- Home buying tips

- Refinancing

- Banking tips

- Money management advice

- Tips to avoid money mistakes

- Personal Finance books

- Mobile loans

- Personal finance blog reviews

- Personal finance loans apps review

- Insurance claim

- Work-from-home ideas

- Managing home expenses

- Investment advice for teens

- Tips to cut down car cost

- Tips to cut down daily expenses

- Finance management tools

- Trading

- Bookkeeping for home expenses

- Bookkeeping for start-up

- How to gain financial freedom

- How to get rich

- Entrepreneurial mindset

- Billionaires and their stories

How to become a personal finance blogger

These are the steps to follow;

1. Learn SEO:

Search Engine Optimization is the secret to becoming a successful personal finance blogger.

You’ll need to know:

- off-page SEO (Keyword research)

- On-page SEO (optimizing your website’s content for search engine ranking)

This include:

- Writing valuable & plagiarism free content

- Optimising your headings and subheadings with either H1, H2, H3, H4, H5 or H6 tags

- Meta description and

- Image optimization

3. Choose a Niche:

- Choose one of the sub-niches in personal finance

- Do keyword research to know its search volume.

4. Build your blog:

Choose a website name and Webhosting service provider and build your personal finance blog.

It is important to build your host your website with a reliable web hosting company. This is necessary because a poorly hosted blog will load slowly and this will impact its negatively search ranking.

Some recommended and beginner-friendly web hosting companies include;

- Bluehost

- Interserver

- Namecheap and

- Google cloud web hosting

How to build a successful personal finance blog in 2023

Steps to be a successful personal finance blog;

- Choose a niche and narrow it down to a sub-niche

- Choose a name (URL or website address)

- Decide on a web hosting company

- Register the domain name and hosting

- Install WordPress and build your site

- Optimize your website and submit it to Google for indexing.

- Write and publish SEO-optimized content consistently

- Apply for Google Adsense (or sign up for an affiliate program)

This process takes less than 1-month to complete.

If everything is done right, your website will be approved for AdSense in a short time.

Continue updating your blog with helpful content.

To grow your blogging career, keep learning to become better at content creation and SEO.

Key Takeaways

- Personal finance ranks among the top most profitable niches in the world with a combined 82,700 search volume on Google (60,500) and Youtube (22,200).

- The top personal finance bloggers make $200,000 to one million dollars a year, this validates the earning potential for the personal finance niche

- Profitable personal finance blogs contain valuable, plagiarism-free articles

- Namecheap, Bluehost, Interservers and Google Cloud Webhosting are beginner-friendly web hosting companies to buy your domain names and web hosting.

RECOMMENDED ARTICLES:

1. How to Make Money with A Blog Fast

2. How to Make Money from a Travel Blog (Verified)

3. How to Start a Food Blog and Make Money

4. How to Write Sponsored Blog Posts and Get Paid

5. How To Become An SEO Content Writer (The Complete Guide)